前面幾篇文章有略為提到不動產投資前台(Front Office)和後台(Back Office)的工作,收到有些朋友問我前後台指的是什麼,這一篇就來就我的個人經驗和大家分享一下。

通常大家較常聽到的可能會是投資銀行的前台或後台,但不動產金融似乎較少被提及,因此很多人會覺得這是個相對神秘的領域,也較難從網路獲取資訊(尤其台灣在這方面的討論更少,顯示這個領域在台灣的需求及供給都較少)。通常來說,區分前後台一個重要的指標,就是是否「和客戶直接對接」及「產生營收」直接相關。

以不動產金融來說,基本上也是以這樣的概念來作區分,前台通常指的就是交易及取得資產的部門,而後台則是負責接手投資部門取得的資產,透過實際營運活動來產生固定的淨營業收入(NOI, Net Operating Income)的單位。

前台所隸屬的部門通常會是投資部,常見的職涯發展為投資分析師(Investment Analyst)、投資經理(Investment Manager)、副總裁(VP)、投資長(CIO)。

後台所涉及的部門通常會是投資組合管理(Portfolio Management)、資產管理(Asset Management),以及物業管理(Property Management)。很多人會對這三種類型工作的職責不太清楚,簡單來說,投資組合管理(Portfolio Management)層面是從整個Portfolio的角度出發,可能會涉及物業投資國家、物業投資類型佔比等內容進行整體的調配及管理,考量市場當前對哪個國家、類型的資產最為青睞,進而與投資部門協調物業的取得及出售。資產管理(Asset Management)會從一個較宏觀的角度看待不動產的管理,負責擬定不動產管理計畫的執行等,最後再交付物業管理(Property Management),進行每日例行及細節的不動產管理工作。

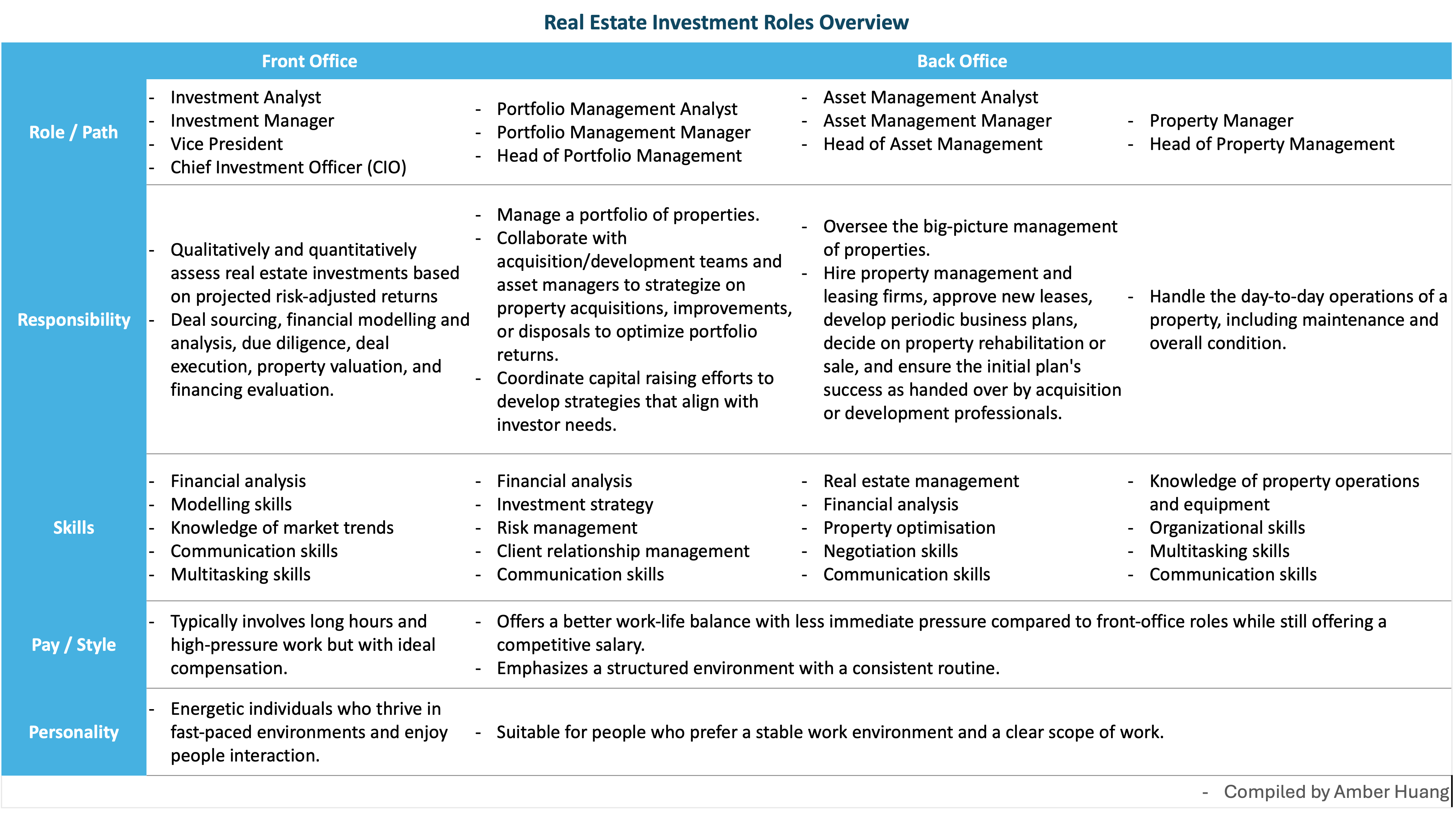

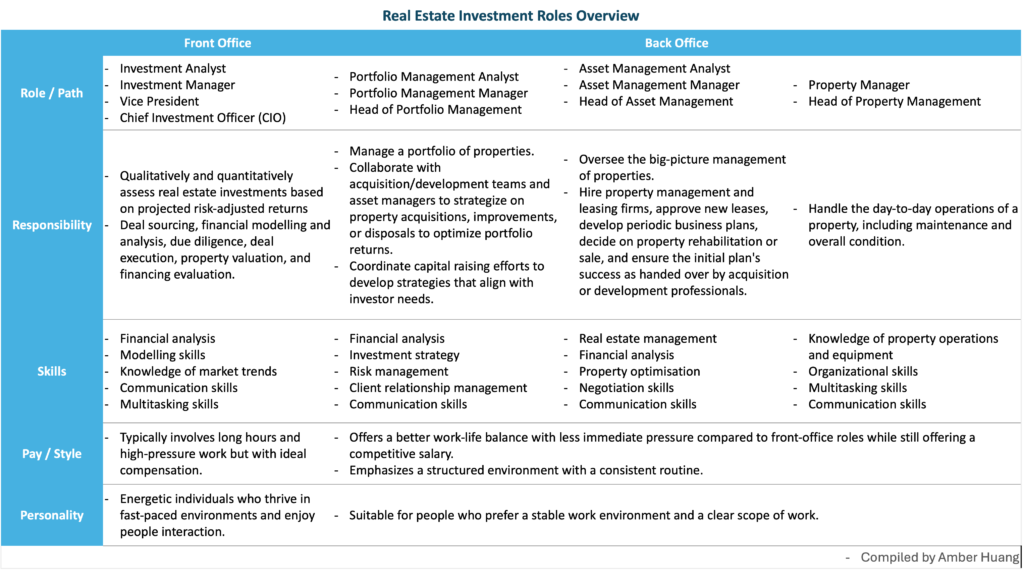

詳細介紹可以參考下面的表格:

前台及後台怎麼選擇?

以我個人前後台的經驗,羅列我所認為的優點和缺點:

前台|不動產投資

- 優點

- 著眼角度較為廣泛:由於不動產業有「經濟發展火車頭」之稱,故涉及的層面相當廣泛。當評估一個案件時,需要思考該國的經濟前景、當地市場法規、房地產市場供需、租金及未來增長預期、利率政策走勢、稅務計徵、營運費用(Opex)、資本支出(Capex)預測、實際營運表現、未來增值空間等,綜合上述所有因素,將條件放到財務模型中進行模擬,才能得出案件的投資報酬率,並決定是否進行投資。若是思考的視野不夠周延,做出來的模型可能就會是GIGO(Garbage in, garbgage out),不夠具有參考價值,也會影響投資決策的判斷。

- 訓練邏輯思考及溝通能力:由於上述假設皆會對投資報酬率有重要影響,所以假設基本上都要有實際數據或資料去做支持。當被投資委員會(Investment Committee)及各種利害關係人挑戰的時候,需要有明確的證據去回答為什麼對租金、出租率、出售價格、Opex、Capex等會是如此的假設,所以邏輯思考能力可能會在不知不覺中被鍛鍊出來,以及找佐證資料支持自己論點的能力也會在無形中被提升。

- 工作內容充滿變化:不同的投資案會有不同的細節,諸如所在市場、項目條件及營運狀況等,基本上很難會找到兩個一模一樣的房地產項目,因此每次幾乎都會可以接觸到新的事物,對於喜歡挑戰不同事物的人來說,每天的工作日常可能會比較有變化。

- 成交案件的成就感:完成案件時的成就感與快感較為具體,尤其當看到自已經手的項目矗立在眼前時,那種成就感真的會蠻強烈的,也會成為一個鼓勵自己在前台支持下去的原因。

- 缺點

- 節奏快、壓力大:當案件有急迫性時,為了掌握交易流程,不管週末平日,加班工作可能會是蠻正常的事情。

- 易受市場景氣影響:與大環境變化影響甚深,若是市場不景氣時,從募資開始到投資活動,甚至銀行貸款,一連串涉及環節可能都會因此變得較為保守,而難以照計畫進行資金的去化或出場(例如Covid一開始時,投資人都傾向較為保守的態度,不但募資不若以往順利,對未來市場發展的不確定性可能也會讓大家選擇較為謹慎地去進行不動產的買賣,以及對不動產投資影響甚深的銀行融資在放貸評估上可能也會變得較為謹慎,各國聯準會政策利率也會劇烈影響投資成本及市場的活躍程度)。

後台|不動產基金管理

- 優點

- 工作內容可以預測:工作內容通常有一定的架構在,可以比較按照既有的排程走,也比較可以安排自己的工作時程及計畫。

- 較好的work-life balance:由於通常工作的未知性較小,比較小的機率會遇到突發的事情或狀況,壓力及節揍通常會較前台小,有比前台高的機率可以準時下班,會有較佳的work-life balance。

- 工作較為穩定:因主要隸屬營運單位,就算遇到景氣或大環境不佳,工作穩定性可能也較不容易受到影響,因為既定的事物仍然需要營運單位執行。除非真的是遇到公司將資產變賣的情形,才比較有可能會因為組織縮編而受到裁員的影響。

- 缺點

- 工作內容較無變化:由於工作大概有一定的週期,所以可能每個週期面臨事的事件是差不多的,比較少會有突發狀況的產生。

- 成就感來源較為單一:成就感可能來自於將每日工作按部就班地完成,或是達成年度目標預算訂定的目標。

總結

以前台投資類型的工作來說,我蠻喜歡這種top-down analysis的感覺,雖然要思考的層面很廣泛,涉及溝通的層面亦較為複雜,但會讓我有種在玩模擬經營遊戲的感覺,我喜歡這種擬定策略並取得結果的過程。尤其是看到案件成功取得並交由營運團隊經營上軌道後,真的會有種莫名的成就感,似乎在驗證自己當初建立的模型假設是對的。另外,當去到不同國家時,親眼看看自己當初投資的項目,這種感覺又會是一種「啊我的工作真的有在do something」的感覺。

以後台工作來說,相較之下成就感似乎就比較沒那麼具體。獲得成就感的來源,來自按部就班將例行的工作完成,例如每月、每季、年度的投資績效報告等,或是依照預算設定目標想辦法使營運達到目標。好處是通常工作節奏都是蠻能預期的,擁有相對較佳的work-life balance。

分別和一些從事前台及後台的朋友聊過,發現適合兩種工作型態的人,個性差異其實頗大。

前台因為要進行比較多的跨部門、跨公司溝通,所以感覺會受到偏E類型的人青睞;而後台通常面對的對象較為單純且可以預期,故似乎偏I類型的人會覺得較為得心應手。我發現,喜歡前台的人,可能會較為重視事工作的新鮮感,也會比較希望自己能掌握工作的各個環節,通常不太喜歡被動地交付工作,而是喜歡主動出擊的去尋找可能的投資標的。像我們投資長(CIO)之前本來也是比較偏顧問、諮詢的背景,但是後來發現自己更喜歡「做交易」的感覺,才從偏幕後的角色換到一線的投資工作,並且一做就再也沒回頭。我也詢問過身邊一些非從事不動產金融的朋友,前台或後台類型的工作他們會傾向如何做抉擇,大致上他們選擇的方向,也和他們外顯的個性相符。喜歡新鮮感的朋友通常會選擇前台,喜歡穩定或按部就班完成工作的朋友,通常也是較為青睞後台類型的角色,而且聽起來要前台個性的朋友從事後台類型的工作,或後台個性的朋友從事前台的工作,似乎對兩方來說都會是蠻不容易的切換。

這些優點和缺點,也都只是相對應的概念,沒有絕對的好與壞,也和個人當下的職涯發展目標和人生階段有很大的關聯。一般來說,後台的工作節奏可能會比較適合有家庭的人,當家庭是現下人生重視的目標時,工作的穩定及可預期性可能就會比追求新鮮感來得重要許多。

前台後台的職涯規劃?

以我觀察到的例子而言,若是職涯發展從前台開始,未來想跳到後台的機率通常會較為容易,因為在前台所累積的經驗及技能其實對後台工作來說也是相輔相成;但若要從後台跳到前台,雖然經驗仍然會有一定的幫助,但是因為兩種工作所需的技能差異其實差異頗大,例如尋找案件(Deal sourcing)、財務建模(Financial modelling)及盡職調查( Due dilligence)等,是後台可能會較難累積到的經驗,所以若是職涯發展從後台開始但未來有考慮跳到前台,建議短暫的累積經驗後便可以試著找找看前台的幾會,可能會是比較容易的發展方向。

2024年產業現況

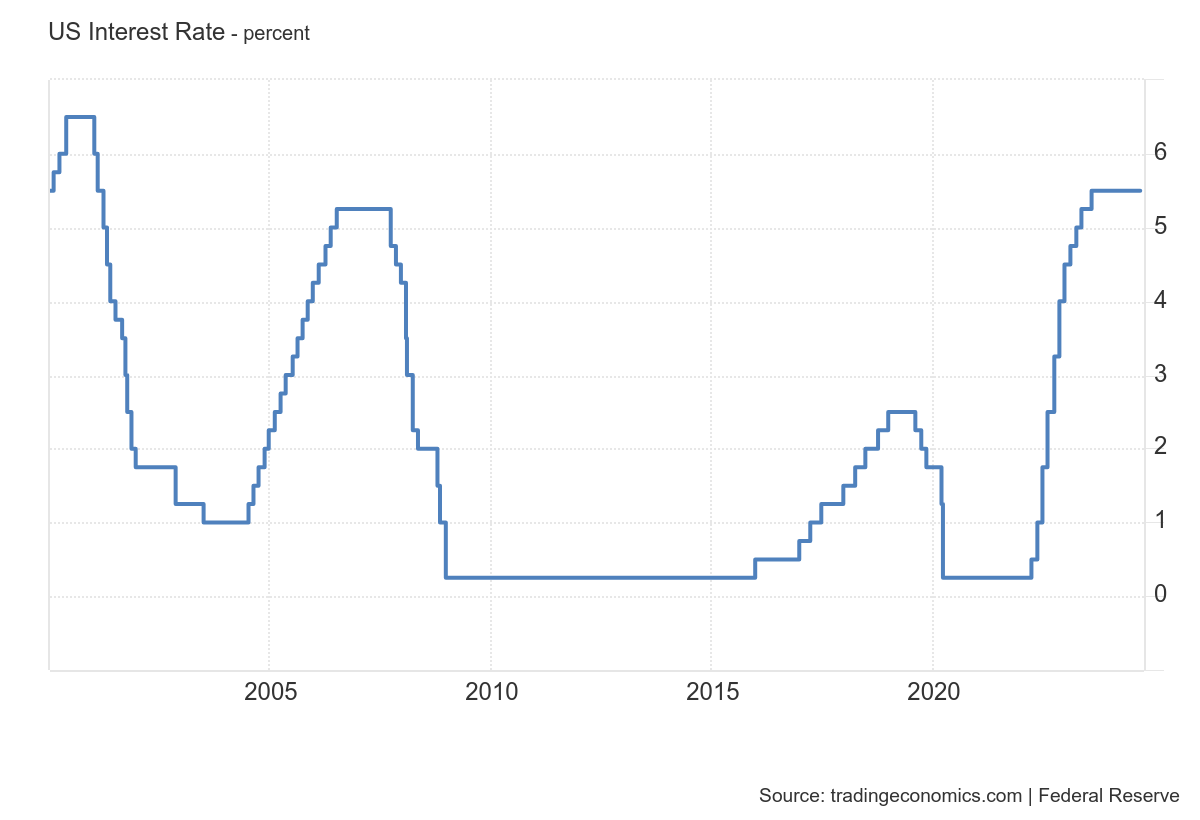

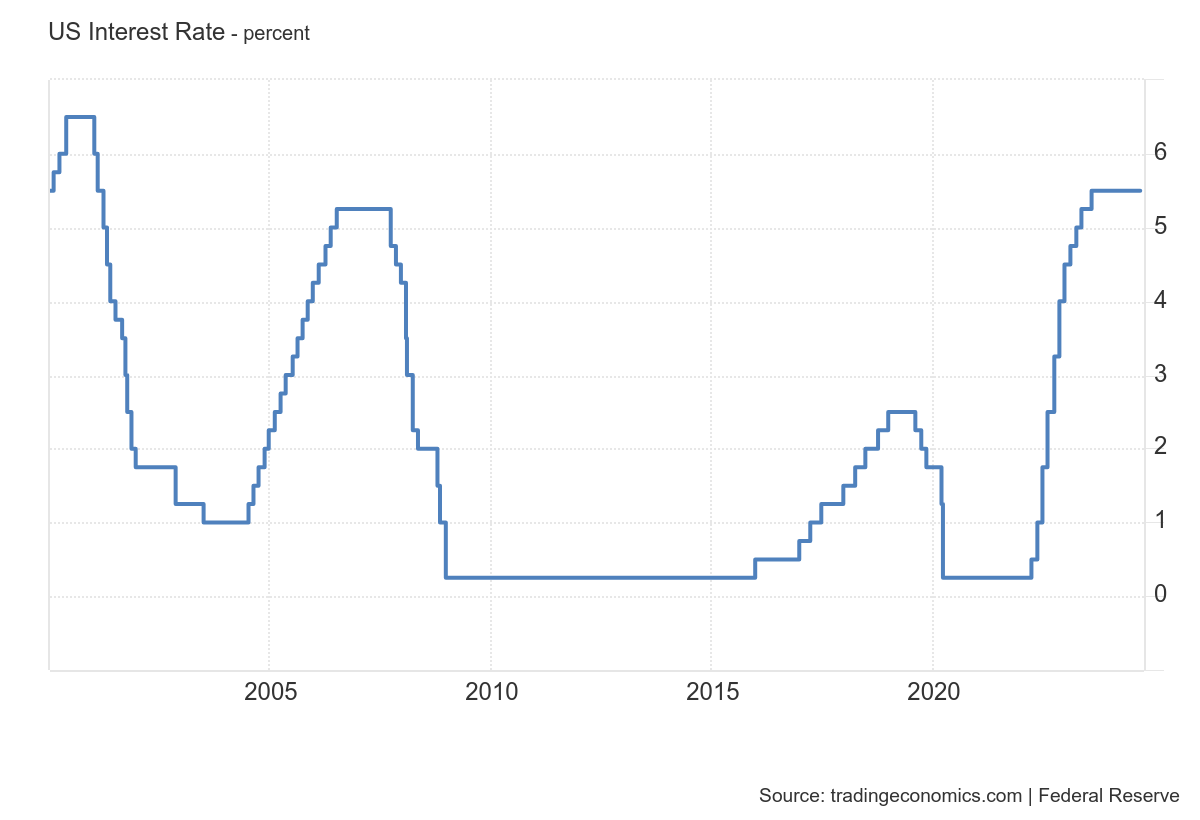

能夠選擇自己工的作內容,總是為最理想的狀態;然而最近的市場,由於疫後美國聯準會(Fed)開始持續收緊利率政策,導致2023年投資市場其實是相對充滿不確定性的,加上中國及香港市場經濟衰退,更讓很多原本以中國及香港為資產配置(Portfilio Allocation)重點的公司成為重災區。在Fed遲遲未調降市場利率的情況下,投資市場的不明朗持續蔓延,也進一步導致市場的募資活動的難度增加,對以資金(Dry Powder)為活水的投資部門來說,募資不順利基本上等於斷了銀根,落入了巧婦難為無米之炊的窘境,因此今年新加坡其實可以聽到不少投資部門傳出裁員的消息,相較之下,偏後台的資產管理部門可能類似的市場風險就會較為間接。

和同事聊及此事,認為Covid時期,政策利率長期維持在0.25%區間的低利環境應該很難再重演了,當時企業大舉借款投資擴張的榮景至少短期內應該難以重現(尤其是不動產市場,低利率使得借款成本相對低廉,更是大舉擴張的好時機,與現在政策利率處於5.5%區間是完全相反的情況)。短期而言(希望只是短期),投資市場將持續被不確定性籠罩,而最近新加坡投資市場的氛圍也是處於有工作機會就不錯了的情況,許多公司要不是裁員就是凍結headcount,對於求職者來說也是相對辛苦的一年。目前能做的,似乎也只能持續精進自己的能力,並等待市場恢復的時候抓住機會。職涯規劃是一回事,但找到合適的工作,真的也是很看運氣呀!

Data Source: Trading Economics

In previous posts, I have briefly mentioned the roles of the Front Office and Back Office in real estate investment. Some friends have asked me to elaborate on what these terms mean, so in this post, I’ll share my personal experience and insights.

When it comes to the financial sector, most people are more familiar with the Front Office and Back Office of investment banks. However, real estate finance is seldom discussed, leading many to perceive it as a more mysterious field with limited information available online. This is especially true in Taiwan, where discussions on this topic are even scarcer, reflecting a lower demand and supply in this sector. Generally, one key criterion for distinguishing between the Front and Back Office is whether the role involves direct client interaction and is directly related to revenue generation.

In real estate finance, the same concept applies. The Front Office typically refers to departments responsible for transactions and asset acquisition, while the Back Office handles assets acquired by the investment team, generating steady Net Operating Income (NOI) through ongoing operational activities.

The Front Office usually encompasses roles within the investment department, with common career paths progressing from Investment Analyst to Investment Manager, Vice President (VP), and Chief Investment Officer (CIO).

The Back Office generally involves departments such as Portfolio Management, Asset Management, and Property Management. The responsibilities of these three types of roles are often unclear to many. In simple terms, Portfolio Management focuses on the overall portfolio, balancing property investments across countries, asset types, and other factors. It involves coordinating with the investment department on acquisitions and disposals based on market preferences. Asset Management takes a more strategic approach to managing real estate, implementing property management plans, which are then executed by Property Management, who handle the day-to-day and detailed management of the properties.

A more detailed overview is available in the table below:

Choosing Between Front Office and Back Office

Based on my experience in both the Front and Back Office, here are what I consider the advantages and disadvantages of each:

Front Office | Real Estate Investment

- Advantages

- Broader Perspective: Real estate is often referred to as the “engine of economic momentum” and covers a wide range of aspects. When assessing a deal, one must consider the economic outlook of the country, local market regulations, real estate market supply and demand, rental rates and growth expectations, interest rate trends, tax considerations, operating expenses (Opex), capital expenditure (Capex) forecasts, operational performance, and future value appreciation potential. All these factors are integrated into a financial model to simulate potential returns and decide whether to invest. A narrow view can lead to a model that is “Garbage In, Garbage Out” (GIGO), lacking reliability and influencing investment decisions.

- Development of Logical Thinking and Communication Skills: Since all the above assumptions significantly impact the return on investment, they must be supported by actual data or evidence. When challenged by the Investment Committee or other stakeholders, one needs solid evidence to justify assumptions related to rent, occupancy rates, sale prices, Opex, Capex, and more. As a result, logical thinking skills may develop unconsciously, as well as the ability to find evidence to support one’s arguments.

- Varied Job Content: Each investment deal comes with different details, such as market conditions, project requirements, and operational situations. It is rare to find two identical real estate projects, so there is always something new to learn. For those who enjoy tackling different challenges, daily work life may be more dynamic.

- Sense of Achievement from Closing Deals: The sense of accomplishment and satisfaction from closing a deal can be quite tangible. Especially when you see a project you handled standing before you, it can be a powerful motivator to continue thriving in the Front Office.

- Disadvantages

- Fast-Paced with High Pressure: When deals are time-sensitive, it is quite common to work overtime, regardless of weekends or weekdays, to manage the transaction process.

- Susceptible to Market Conditions: The role is heavily influenced by external market conditions. If the market is down, everything from fundraising to investment activities, and even bank loans, may become more conservative, making it challenging to follow through with planned investments or exits (such as during the initial phase of COVID-19, when investors adopted a more cautious attitude, making fundraising less smooth and causing uncertainty about future market developments).

Back Office | Real Estate Fund Management

- Advantages

- Predictable Work Content: The job usually follows a set structure, allowing for more predictable scheduling and planning of one’s work routine.

- Better Work-Life Balance: Since the job is generally more predictable and less prone to unexpected situations, the pressure and pace are typically lower compared to the Front Office. There is a higher chance of leaving work on time, leading to a better work-life balance.

- Job Stability: Since the Back Office is mainly an operational unit, even in adverse economic conditions, the stability of the role is less likely to be affected because established processes still require execution. Only in cases where a company decides to liquidate its assets might the risk of redundancy arise.

- Disadvantages

- Less Variety in Job Content: Given that the work usually follows a certain cycle, the events faced in each cycle tend to be similar, with fewer unexpected situations.

- More Limited Sources of Fulfilment: Satisfaction often comes from routinely completing daily tasks or achieving set annual budget targets.

Conclusion

Regarding Front Office investment roles, I particularly enjoy the top-down analysis aspect. Although it requires a broad range of considerations and involves complex communication, it feels like playing a strategy simulation game—I relish the process of strategising and achieving results. There’s a sense of fulfilment when a deal is successfully acquired and handed over to the operations team, validating the assumptions in my original model. Moreover, seeing the projects I invested in when travelling to different countries brings a unique sense of “Ah, my work is really doing something”

As for Back Office roles, the sense of achievement seems less tangible by comparison. The satisfaction mainly comes from diligently completing routine tasks, such as monthly, quarterly, or annual investment performance reports, or ensuring operations meet budgeted goals. The advantage, however, is that the work pace is usually more predictable, offering a relatively better work-life balance.

From discussions with colleagues working in both Front and Back Offices, I’ve observed that the personalities suited to these two types of roles can be quite different.

From discussions with colleagues working in both Front and Back Offices, I’ve observed that the personalities suited to these two types of roles can be quite different. The Front Office involves a lot of cross-departmental and cross-company communication, which tends to appeal to more extroverted (E) types. Meanwhile, the Back Office, which deals with more predictable and straightforward interactions, may be more comfortable for introverted (I) types.

I also noticed that those who prefer Front Office roles often value the freshness and like having control over various aspects of their work. They are not keen on passively receiving tasks but rather enjoy proactively seeking potential investment opportunities. For example, our CIO, who originally had a background in consulting, realised they preferred “making deals” and transitioned from a more behind-the-scenes role to a frontline investment position, and they’ve never looked back.

After talking with some friends outside the real estate finance industry, I found that their choice between Front Office and Back Office roles also aligns with their apparent personalities. Friends who crave novelty often choose the Front Office, while those who prefer stability or systematic work lean towards Back Office roles. It seems that making a switch between these roles, especially when the personality type is mismatched, could be quite challenging.

These pros and cons are, of course, relative concepts, with no absolute good or bad. It also heavily depends on one’s current career development goals and life stage. Generally speaking, Back Office roles might be more suitable for those with families, where job stability and predictability may outweigh the pursuit of novelty.

Career Planning Between Front Office and Back Office?

From what I’ve observed, those who start their careers in the Front Office generally find it easier to transition to the Back Office later. The skills and experience accumulated in the Front Office often complement Back Office roles. However, moving from the Back Office to the Front Office, while still beneficial to some extent, can be more challenging due to the specific skills required, such as deal sourcing, financial modelling, and due diligence, which may be harder to acquire in a Back Office role. If one starts in the Back Office but wishes to move to the Front Office, it might be advisable to consider such a move early in their career.

Industry Outlook in 2024

Choosing one’s work content is always the ideal scenario. However, the current market environment, with the post-pandemic tightening of interest rate policies by the US Federal Reserve, has made the investment landscape in 2023 relatively uncertain. The economic downturn in China and Hong Kong has further affected companies that focused heavily on these markets for portfolio allocation. With the Fed yet to lower interest rates, the ongoing market ambiguity has made fundraising activities more challenging. For investment teams that rely on capital (dry powder), unsuccessful fundraising essentially means a cash flow drought. As a result, we have heard of layoffs in many investment teams in Singapore this year. In contrast, the more Back Office-focused asset management departments face relatively less direct market risk.

Discussing this with colleagues, we believe that the low-interest-rate environment (0.25%) during the COVID-19 period is unlikely to repeat. The period of significant borrowing and expansion by companies, especially in the real estate market, where low borrowing costs facilitated expansion, is in stark contrast to the current environment with policy rates around 5.5%. In the short term (hopefully, just the short term), the investment market will continue to be clouded by uncertainty. The sentiment in the Singapore investment market is also cautious, with companies either laying off staff or freezing headcount, making it a tough year for job seekers. What we can do now is to keep improving our skills. Career planning is one thing, but finding the right job often comes down to a matter of luck!

Data Source: Trading Economics

5 comments

Thanks for the comprehensive introduction. It helps me to make my career decisions in the CRE industry.

台灣感覺不動產業能選擇的類型好像沒有這麼多元

真的…個人也是比較想找傾向前台類型的工作,但好像除了壽險外就沒有什麼其他機會:(

壽險業投資一點都不自由,一大堆內部人為因素⋯

感覺還是受金管會影響很深😂也好想聽聽看這方面的故事